Offshore Company Formation: Specialist Tips and Insights

Techniques for Cost-Effective Offshore Business Development

When considering overseas firm development, the pursuit for cost-effectiveness ends up being a critical concern for services looking for to expand their operations internationally. In a landscape where financial carefulness rules supreme, the techniques used in structuring offshore entities can make all the difference in attaining economic efficiency and operational success. From browsing the complexities of territory option to carrying out tax-efficient structures, the trip in the direction of developing an offshore existence is swarming with difficulties and opportunities. By discovering nuanced methods that mix lawful conformity, financial optimization, and technical innovations, companies can start a path in the direction of overseas business development that is both financially prudent and purposefully sound.

Picking the Right Jurisdiction

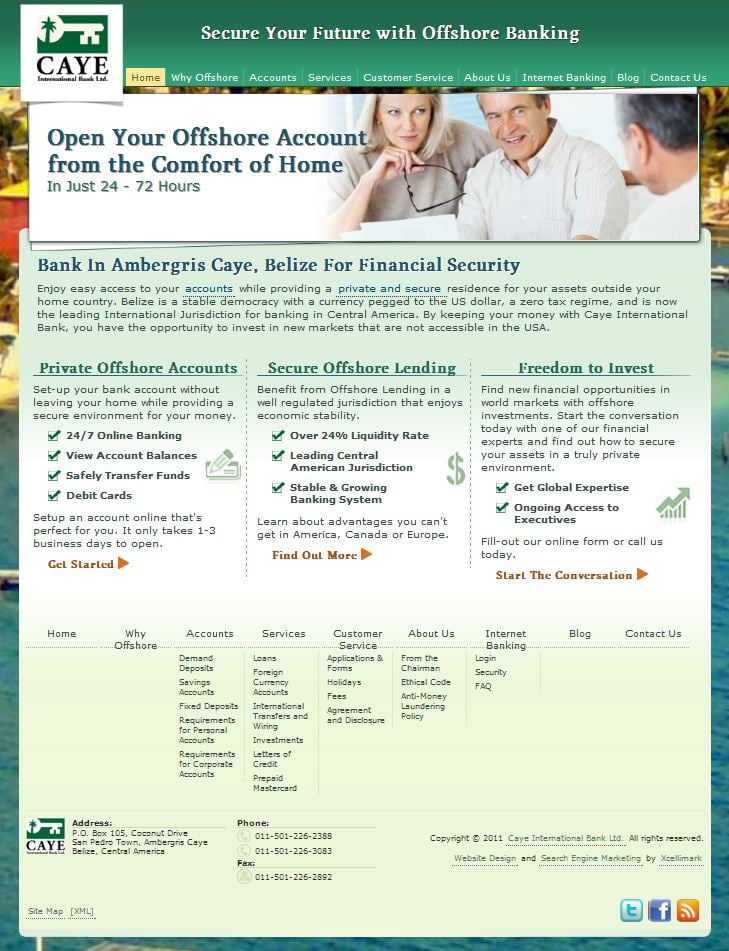

When establishing an overseas business, selecting the suitable jurisdiction is an essential choice that can considerably impact the success and cost-effectiveness of the formation procedure. The jurisdiction picked will certainly figure out the regulative framework within which the company runs, affecting tax, reporting requirements, personal privacy laws, and total service versatility.

When choosing a territory for your overseas company, several aspects must be considered to make sure the choice aligns with your tactical goals. One crucial aspect is the tax obligation routine of the jurisdiction, as it can have a substantial influence on the firm's profitability. Furthermore, the level of regulatory conformity required, the economic and political security of the jurisdiction, and the ease of operating has to all be examined.

In addition, the track record of the jurisdiction in the global business community is vital, as it can affect the understanding of your company by clients, partners, and banks - offshore company formation. By carefully examining these elements and looking for expert guidance, you can pick the ideal jurisdiction for your offshore firm that enhances cost-effectiveness and sustains your service purposes

Structuring Your Company Successfully

To guarantee ideal performance in structuring your offshore company, careful focus has to be offered to the business framework. The initial step is to specify the business's ownership framework plainly. This consists of figuring out the officers, directors, and shareholders, in addition to their responsibilities and functions. By developing a clear possession framework, you can guarantee smooth decision-making procedures and clear lines of authority within the business.

Next, it is vital to think about the tax effects of the picked structure. Different territories use differing tax obligation advantages and motivations for offshore business. By very carefully analyzing the tax obligation regulations and laws of the chosen territory, you can enhance your company's tax obligation performance and lessen unneeded expenditures.

Moreover, maintaining appropriate documentation and documents is important for the efficient structuring of your offshore business. By keeping current and exact documents of economic transactions, business decisions, and compliance records, you can ensure openness and accountability within the company. This not only facilitates smooth operations however likewise helps in demonstrating compliance with governing requirements.

Leveraging Innovation for Financial Savings

Efficient structuring of your overseas company not only hinges on precise focus to business frameworks yet additionally on leveraging technology for financial savings. One means to utilize innovation for cost savings in offshore firm formation is by making use of cloud-based solutions for information storage space and cooperation. By incorporating modern technology purposefully right into my latest blog post your overseas company formation process, you can accomplish considerable cost savings while improving operational effectiveness.

Minimizing Tax Responsibilities

Using strategic tax preparation strategies can successfully lower the economic concern of tax obligations for offshore firms. In addition, taking advantage of tax rewards and exceptions offered by the jurisdiction where the overseas business is registered can result in substantial savings.

An additional strategy to decreasing tax responsibilities is by structuring the offshore business in a tax-efficient manner - offshore company formation. This involves very carefully making the possession and functional framework to enhance tax obligation advantages. For circumstances, establishing a holding firm in a jurisdiction with favorable tax legislations can help combine profits and decrease tax obligation direct exposure.

Furthermore, staying upgraded on international tax policies and conformity demands is vital for reducing tax obligation liabilities. By ensuring stringent adherence to tax obligation legislations and policies, offshore business can avoid costly fines and tax conflicts. Seeking specialist suggestions from tax obligation professionals or legal specialists concentrated on international tax issues can additionally provide valuable insights right into efficient tax planning strategies.

Guaranteeing Compliance and Threat Mitigation

Implementing durable conformity actions is crucial for overseas firms to alleviate dangers and preserve governing adherence. To ensure compliance and minimize dangers, offshore business should conduct complete due diligence on customers and company partners to avoid involvement in illicit tasks.

Additionally, remaining abreast of changing policies and lawful requirements is crucial for overseas companies to adjust their conformity methods accordingly. Engaging legal professionals or conformity experts can give useful advice on browsing complex governing landscapes and ensuring adherence to international criteria. By prioritizing conformity and danger mitigation, offshore business can improve openness, construct trust fund with stakeholders, and secure their operations from possible lawful repercussions.

Conclusion

Using critical tax planning techniques can properly reduce the financial problem of tax liabilities for offshore companies. By distributing revenues to entities in low-tax territories, offshore firms can legitimately decrease their general tax commitments. Furthermore, taking benefit of tax obligation incentives and exemptions provided by the jurisdiction where the overseas business is registered can result view it now in substantial cost savings.

By making sure rigorous adherence to tax obligation regulations and regulations, offshore business can prevent pricey charges and tax disputes.In verdict, cost-efficient offshore firm formation requires mindful factor to consider of jurisdiction, effective structuring, modern technology utilization, tax reduction, and compliance.